The Human Moat, Reputation Network Asymmetry in Agentic Economies

How trust networks become the new gatekeepers of market-moving information

Human credibility becomes the ultimate scarce asset in an AI-dominated trading future

In the swirling convergence of artificial intelligence and decentralised finance, a new market structure is emerging that transcends traditional boundaries. As AI agents will increasingly dominate both prediction markets and DeFi trading, human reputation will evolve from a social signal into a tradeable, verifiable asset. Welcome to reputation markets, where your credibility becomes a multiplier of your currency, and trust networks determine who gets access to alpha data sets in real time.

The Algorithmic Efficiency Paradox

Traditional prediction markets operate on the wisdom of crowds, aggregating diverse human perspectives to forecast future events. DeFi markets, meanwhile, have created permissionless financial primitives where anyone can trade, lend, or provide liquidity. Both systems assume human participants making decisions based on incomplete information and emotional biases.

But what happens when the participants are always online?

As AI agents flood these markets with superhuman information processing capabilities, they're creating an efficiency paradox. Markets become incredibly accurate at pricing known variables while simultaneously becoming vulnerable to information they can't process.

Cultural context, human irrationality, and most importantly, manufactured signals designed to exploit their algorithmic blind spots.

This is where reputation markets emerge as a missing piece of the puzzle.

Human-to-Machine Translation Layer

Reputation markets is another way of understanding the codification of humanity's oldest coordination games into machine-readable infrastructure.

Something inevitable as we adopt and share trust with multiple AI digital twins.

Throughout history, humans have naturally organised around trust networks, gatekeeping valuable information through social hierarchies, professional guilds, and insider circles. We instinctively share critical insights with those we trust while withholding them from those we don't. We build credibility through consistent performance, vouch for others' reliability, and create informal information cascades that flow through social networks based on reputation gradients.

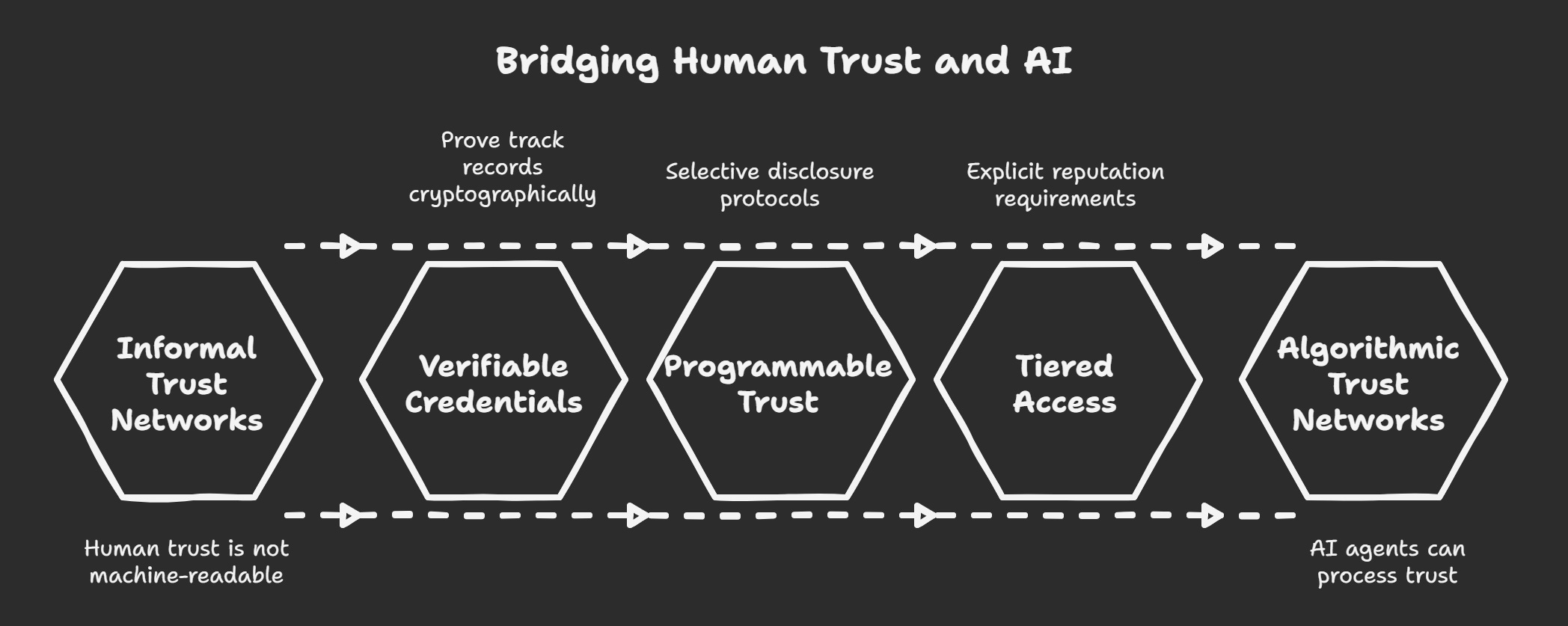

What reputation markets will accomplish is the translation of these deeply human social behaviours into a format that AI agents can process, verify, and price.

Instead of informal social capital that exists in human memory and cultural context, we create cryptographically verifiable credentials that prove track records.

Instead of whispered conversations and knowing glances, we build programmable trust networks with selective disclosure protocols.

Instead of social hierarchies based on unspoken understanding, we construct tiered access systems with explicit reputation requirements.

The genius isn't in inventing new human behaviours, but in making our natural information-sharing instincts legible to algorithmic systems. This creates a bridge between human cultural intelligence and machine computational power, allowing the same social dynamics that have coordinated human societies for millennia to function seamlessly in an economy dominated by AI agents.

Prediction Markets vs DeFi Under Agentic Dominance

The transition to AI-dominated trading creates fundamentally different dynamics in prediction markets versus DeFi markets, differences that reveal where human competitive advantages persist and where new vulnerabilities emerge.

Prediction Markets: The Quantifiable vs. The Cultural

In prediction markets populated primarily by AI agents, we witness dramatically enhanced accuracy for quantifiable events coupled with systematic blind spots for culturally nuanced scenarios. AI agents excel at processing vast datasets, polling data, social media sentiment, satellite imagery, economic indicators, and translating them into betting positions within milliseconds. They can simultaneously analyse historical voting patterns, demographic shifts, and economic indicators to price political outcomes with remarkable precision.

However, prediction markets under agentic dominance reveal a critical flaw: they become extraordinarily accurate at pricing events that fit historical patterns while systematically mispricing genuinely novel scenarios or events requiring cultural intelligence. An AI agent might perfectly model polling data and economic indicators for an election but completely miss that a candidate's cultural misstep will resonate differently across generational divides in ways that historical data cannot predict.

The "wisdom of crowds" transforms into "convergence of algorithms," which can lead to either remarkable precision or spectacular collective blind spots when all agents operate on similar information processing frameworks.

DeFi Markets: Feedback Loops and Manufactured Volatility

DeFi cryptocurrency markets under AI dominance present a more complex and potentially unstable dynamic. Unlike prediction markets that have external events to eventually validate prices, DeFi markets for many tokens lack traditional fundamental value anchors. This creates a unique environment where AI agents' collective behaviour becomes the primary driver of market reality.

AI agents in DeFi markets can create recursive feedback loops where algorithmic trading strategies interact with each other in unpredictable ways. Unlike human traders who might hesitate before executing large trades due to emotional constraints, AI agents can execute massive positions based purely on technical signals, potentially amplifying volatility rather than dampening it. MEV bots, automated liquidity providers, and arbitrage algorithms create layers of algorithmic interaction that can produce market movements disconnected from any underlying economic reality.

The volatility characteristics diverge significantly from prediction markets. While prediction markets might see reduced volatility as AI agents quickly arbitrage away obvious mispricing, DeFi markets could experience more extreme swings as AI agents execute large trades based on technical signals, unrestrained by human emotional hesitation or position sizing concerns.

Information Processing Asymmetries

The fundamental difference lies in information asymmetries. In prediction markets, there's always an external ground truth, elections happen, weather occurs, sports games conclude. AI agents can be measured against reality, creating natural selection pressure toward accuracy.

In DeFi markets, particularly for tokens without clear fundamental value, "accuracy" becomes circular. If AI agents collectively decide a token is valuable based on technical indicators, liquidity patterns, and network effects, that collective judgment becomes market reality. This creates opportunities for sophisticated human participants who understand how to manufacture the kind of signals that AI agents interpret as valuable.

Human Competitive Niches

These different dynamics create distinct opportunities for human competitive advantage:

In prediction markets, humans retain advantages in interpreting qualitative, contextual, or culturally nuanced information that AI struggles with. A human might better understand the political implications of a candidate's gaffe, the cultural significance of a policy proposal, or when social movements are about to shift in unprecedented ways.

In DeFi markets, human intuition about narrative, community sentiment, and the "vibe" of projects becomes more valuable precisely because it's harder for AI to quantify. The human ability to recognise when something "feels" overvalued based on subjective cultural factors, or to understand when communities are fracturing due to philosophical disagreements, creates arbitrage opportunities that pure technical analysis cannot capture. Its about taste.

The irony is that as markets become more algorithmically efficient at processing quantifiable information, the remaining inefficiencies become more fundamentally human, based on consciousness, culture, and the unpredictable creativity that emerges from human social systems.

Blockchain-Enabled Agentic Expansion

The emergence of reputation markets is inseparable from blockchain's fundamental transformation of internet-scale coordination.

By providing programmable, trustless infrastructure, blockchains enable AI agents to interact autonomously across previously siloed systems, exchanging tokens along the way, transforming and automating trading protocols > information networks > governance.

Therefore it’s safe to assume an exponential expansion of market ‘participants’ almost by the same growth factor as total compute required.

If the velocity of money increases through the automation of optimisation, finding the real price of any given token should be systemically more efficient then right? Or better question, how does this affect volatility?

Where traditional markets might have thousands of human traders, blockchain-enabled agentic networks can support millions of AI agents operating across interconnected protocols. Each agent can simultaneously participate in prediction markets, provide DeFi liquidity, engage in governance voting, and trade reputation tokens, all while maintaining persistent identity and verifiable track records across the entire ecosystem.

The result is unprecedented price discovery efficiency.

With millions of agents processing information and adjusting positions continuously, market volatility decreases as pricing becomes more accurate and responsive.

This isn't just about having more participants, it's about having participants that never sleep, never get emotional, and can process vastly more information than human traders ever could.

However, this efficiency gain creates a new problem: the commoditisation of algorithmic intelligence. When millions of AI agents have access to similar information and processing capabilities, traditional competitive advantages disappear.

The alpha that once came from faster analysis or better data access gets arbitraged away by the sheer volume of sophisticated participants.

The Information Asymmetry Arms Race

This commoditisation of AI-driven analysis is precisely what makes reputation-based information networks not just valuable, but essential for survival. As blockchain enables seamless agentic interactions at massive scale, the competition for genuinely unique information becomes fierce. The participants who thrive aren't those with better algorithms, they're those with access to information networks that AI agents cannot penetrate or replicate.

Here's where human reputation becomes the ultimate gatekeeper.

While blockchain makes it possible for millions of agents to interact efficiently, it also makes it possible to create authenticated, permission-based information networks where access is determined by verified credibility rather than computational power or capital.

These reputation networks create intentional information asymmetries that protect valuable insights from being immediately arbitraged away by the algorithmic masses.

The irony is beautiful: the same blockchain infrastructure that enables massive agentic participation also enables the creation of exclusive trust networks that maintain competitive advantages in an otherwise hyper-efficient market.

The Architecture of Trust

Reputation markets represent a synthesis: they combine prediction markets' focus on information accuracy with DeFi's permissionless, composable infrastructure.

But instead of predicting external events or trading arbitrary tokens, participants are trading access to authenticated human intelligence.

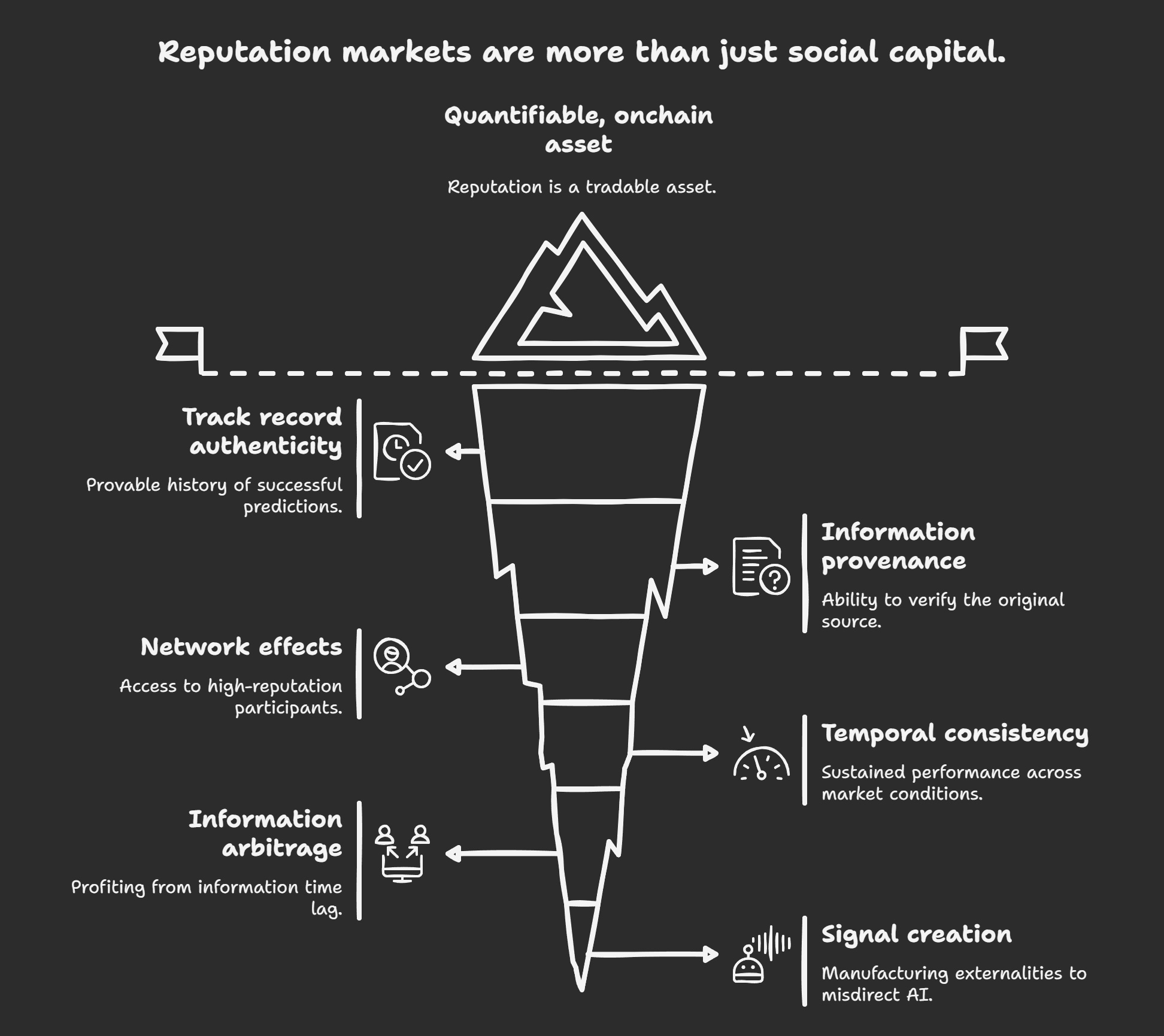

In this new paradigm, your reputation isn't just social capital, it's a quantifiable, onchain asset that grants access to increasingly exclusive information networks.

Most likely a direct result of contributing data, experience and wisdom directly to AI training and context. These aren't traditional social media reputation scores, but sophisticated credibility systems that verify:

Track record authenticity: Provable history of successful predictions or trades

Information provenance: Ability to verify the original source of market-moving insights

Network effects: Access to and endorsement from other high-reputation participants

Temporal consistency: Sustained performance across different market conditions

The genius lies in how these systems create natural scarcity. Unlike tokens that can be minted infinitely, a genuine reputation can only be earned through demonstrated competence over time. This scarcity makes reputation a valuable asset in itself, and in turn, would have gravity when understood by the electronic herd of AI agents.

Information as Infrastructure

In reputation markets, information doesn't flow freely, it cascades through tiered trust networks. High-reputation participants get first access to authentic signals, while lower-tier participants receive information that's already been processed, diluted, or potentially manipulated.

This creates multiple revenue streams:

Direct reputation trading: Selling access to your information network or endorsing others' credibility

Information arbitrage: Profiting from the time lag between when you receive information and when it reaches broader markets

Signal creation: Manufacturing believable externalities that can misdirect AI agents while coordinating real strategies within trusted circles

The most sophisticated participants aren't just traders, they're information architects, crafting complex narratives and manufacturing market conditions that appear natural to algorithmic analysis but are actually designed to create predictable AI responses.

The Human Competitive Edge

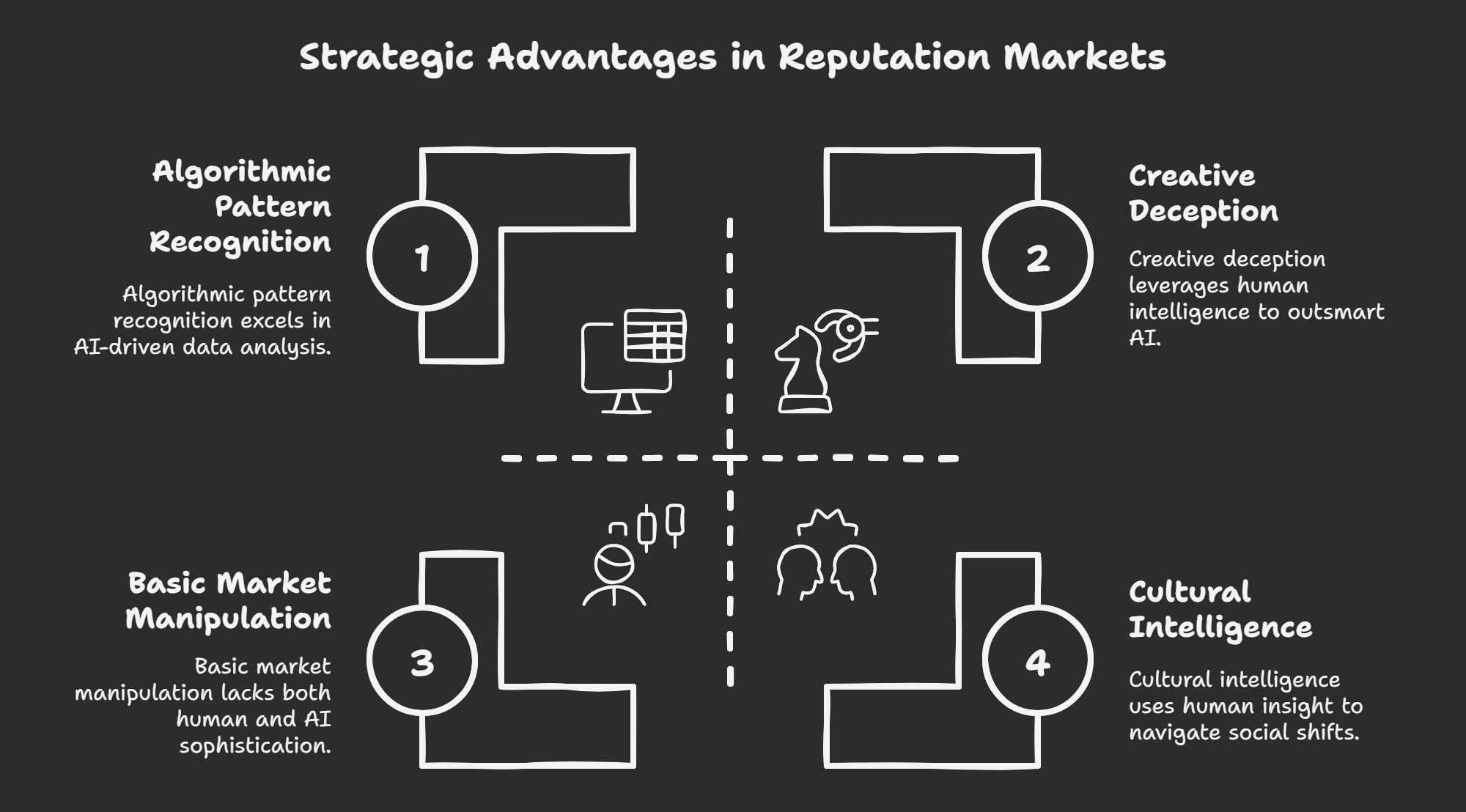

There are some fascinating opportunities for human competitive advantage in this world. While AI agents excel at processing vast datasets and identifying historical patterns, they struggle with:

Cultural intelligence: Understanding when social or political narratives are about to shift in unprecedented ways

Creative deception: Recognising when information has been deliberately manufactured to mislead algorithmic analysis

Meta-market awareness: Understanding how AI systems will respond to specific types of information and gaming those responses

Relationship dynamics: Navigating the complex social graphs that determine who gets access to authentic versus manufactured information

The humans who thrive in reputation markets aren't necessarily the best traders, they're the best at building and maintaining trust networks while simultaneously creating information asymmetries that can be monetised.

Privacy is Normal

Unlike traditional social media reputation systems that require public disclosure, reputation markets benefit from sophisticated privacy-preserving identity systems. Participants need what we might call "authenticated anonymity," the ability to prove their credibility and track record without revealing their specific strategies or sources.

This creates demand for:

Zero-knowledge reputation proofs: Demonstrating your track record without revealing specific trades or predictions

Compartmentalised identity: Managing multiple personas for different market strategies while maintaining verifiable consistency

Selective disclosure: Sharing information with specific network participants without broader exposure

The infrastructure for these privacy-preserving reputation systems becomes as valuable as the markets themselves.

The Economics of Manufactured Reality

Perhaps the most intriguing aspect of reputation markets is how they create economic incentives for manufacturing reality itself.

High-reputation participants can profit by:

Creating believable externalities that trigger predictable AI responses

Coordinating narrative shifts that appear organic but are actually orchestrated

Timing information release to maximise both market impact and network value

This isn't simple market manipulation…it's sophisticated information warfare where the battlefield is the gap between human cultural intelligence and algorithmic pattern recognition.

Beyond Financial Markets

The implications extend far beyond trading. Reputation markets could reshape:

Governance systems: Where voting power is determined by demonstrated competence rather than token holdings

Information verification: Creating economic incentives for accurate reporting and fact-checking

AI training: Where high-reputation humans provide curated training data for specialised applications

Professional services: Where credentials become tradeable assets that can be staked, delegated, or composed into larger trust networks

Network Effects Endgame

As reputation markets mature, we'll likely see the emergence of "reputation DAOs" decentralised organisations that exist primarily to accumulate, verify, and deploy collective credibility.

These entities could:

Pool reputation from multiple high-credibility individuals

Diversify information strategies across different market sectors

Create reputation derivatives that allow speculation on future credibility

Establish credibility standards that become industry benchmarks

The most valuable networks won't be those with the most participants, but those with the highest average reputation and the most exclusive information access.

Trust as the Ultimate Scarce Asset

Reputation markets represent more than just a new financial primitive and externality to consider for ‘real price’ discovery, they're a fundamental shift in how we think about value creation in an AI-dominated world. As artificial intelligence becomes increasingly capable of processing traditional information signals, human reputation becomes the ultimate scarce asset.

The blockchain infrastructure that enables millions of AI agents to interact seamlessly also creates the conditions where authentic human insight becomes exponentially more valuable. The same permissionless systems that reduce market volatility through enhanced price discovery also create the competitive pressure that makes exclusive, reputation-gated information networks essential for maintaining alpha.

The future belongs not to those who can process information fastest, but to those who can create, verify, and monetise authentically human insights. In reputation markets, your credibility isn't just your calling card. It's your competitive moat, your revenue stream, and your key to accessing the increasingly exclusive networks where real alpha is generated.

The question isn't whether reputation markets will emerge, it's whether you've been building your credibility infrastructure in time to participate when they do.

What's your reputation going to be worth,

To whose AI agents?